Health Insurance, Life Insurance, Annuities, Retirement Planning, streamlined and made simple.

Monday, December 20, 2010

Infinite Banking Concept

Thursday, December 9, 2010

How To Achieve Longevity

Saving vs. Investing

Tuesday, December 7, 2010

Lifespan Vs Wealth

Monday, November 29, 2010

Wednesday, November 10, 2010

The Truth About E-Cigarettes

Via: the TermLifeInsurance Blog

Tuesday, November 9, 2010

Charleston Voted Most Attractive

Wednesday, November 3, 2010

Don't Postpone Purchasing Insurance

I have an article here from a friend of mine that sounds all too familiar. I often hear these same words and it is shocking to me. I'll let you read it for yourself.

"I don't need health insurance since I am healthy". No matter how often I hear that it never makes sense.

The guy in the casket at the front of the church probably could use some life insurance but unfortunately it is too late to do anything about it.

Same for health insurance.

You can't buy it once you get sick.

Almost 2 months ago I was referred to a lady who would be needing health insurance when her COBRA expired at the end of September. I called and was told she was busy with other things but she would get around to it soon.

Over the next few weeks we had sporadic contact and then about 3 weeks ago she finally got serious about it. After going back & forth on options she finally agreed to complete an application for coverage. Even then it was a challenge to keep her on task.

Last week she faxed the application to me for review. The next day she emailed to say she had an exam including a colonoscopy scheduled for a few days later. We went through several questions, including questions about any symptoms or family history that might have prompted the colonoscopy.

She assured me there was nothing in her history but her doctor thought it would be a good idea.

By now the only thing we could do was submit the application and hope for the best. During the phone interview with the underwriter they noted she had filled a prescription for Movi-Prep . . . a medication to purge the bowels in advance of the exam.

The carrier opted to postpone taking any action until AFTER the colonoscopy. They were well within their right to do so.

Fast forward to today.

I got a call from her ex, telling me the results of the exam. They found 6 polyps and have sent them off to pathology and are awaiting the results.

Hopefully she will have a good prognosis, but this does put a kink in any plans for applying for health insurance. Now she will have to wait 12 months at a minimum, have a follow up colonoscopy and hope it is clear. Even then, there is no guarantee she can get coverage then.

And about that expiring COBRA . . .

Her only option now is to apply for coverage through the state risk pool.

Sometimes when an agent suggests moving forward it is best to listen to them rather than putting off a decision that limits your options.

If she had applied for the coverage this could have been avoided. Thanks Bob.

Read full story here...

Wednesday, October 27, 2010

Night Owls Smarter than Early Birds

I know this is a little off topic for me but I found it very interesting. A study shows that those who go to bed later in the evening are generally smarter than those who retire early.

Now it is yet to be said if this particular behavior is healthier than early risers but I would think that if the behavior is within a routine or repeated patterns then health would be the same for both.

I have always considered myself a night owl. And this article confirms that more creative and intelligent juices are prevalent. Take a look at this study and let me know what you think.

Read more here...

Monday, October 18, 2010

Individual Mandate is a Serious Crime

Wednesday, October 13, 2010

Benefits to Drinking Alcohol?

I recently came across an article about the merging of two government research organizations (NIAAA, National Institute for Alcohol Abuse and Alcoholism and NIDA, National Institute on Drug Abuse) and whether or not it would be beneficial.

It seems that the argument is based on what the alcohol industry wants us to hear. It is plainly obvious that current drug laws have a "historical and cultural bias" being that drugs are bad and alcohol is socially acceptable.

So now the alcohol backers are feeling discriminated against? You don't want alcohol in the same boat as drugs? Why not? Currently both organizations research nicotine.

Alcoholism is a disease and alcohol itself is widely considered a gateway drug. Can we not research the negative affects? More light needs to be shed on this issue.

Read more here...

Thursday, October 7, 2010

Blood Alcohol Content

Via: Term Life Insurance

Wednesday, October 6, 2010

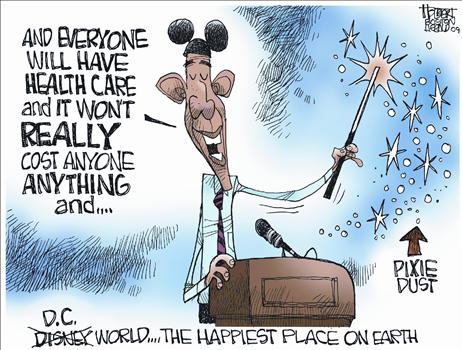

Health Care in a Nutshell

Thursday, September 30, 2010

Most Hazardous Jobs

I was very surprised that they grouped sales people and truckers together. And on top of that, sales workers were killed more than police. I may need to change my profession, it's dangerous.

Via: Term Life Insurance

Monday, September 27, 2010

The 27 Club: Death of a Rockstar

Via: Term Life Insurance

It's hard to believe that they all passed at 27 years old! Funny thing is if they had applied for life insurance after they had drug or alcohol problems, they probably would have been denied. So the tip of the day is, get your life insurance before you binge on alcohol and drugs.

Friday, September 24, 2010

61% Favor Repeal of Health Care Law

Wednesday, September 22, 2010

Save My Commissions, Vote Against Democrats

I personally do not agree with it and I hope that it is repealed for two main reasons:

1. Health care cost more now than it did before,

and

2. I am going to make less money.

Nearly every plan that I can offer is potentially cutting our commission by as much as 50%. Now if you can imagine, half my pay is on the chopping block. SO get to the polls and help a brotha out.

I don't care if it's Libertarian, Republican, Tea Party, get the Dems out and repeal that bill, for my sake lol.

Monday, September 20, 2010

Saturday, September 18, 2010

Top 5 Jobs Not to Have Without Life Insurance

Wednesday, August 25, 2010

8 Simple Steps You Can Take to Reduce Your Exposure to Identity Theft

There's no foolproof way to avoid having your identity stolen, but there are a number of precautions you can take to minimize your odds of being a victim. Here are a few of them:

Tuesday, August 24, 2010

Insurance does not have incentives to lower costs or improve quality | KevinMD.com

Friday, August 20, 2010

What Californians are Really Thinking

—

Alpine Agency

T: +843.532.8367

F: +843.971.1813

http://b-nice-intime.blogspot.com

Find me here too:

Wednesday, August 18, 2010

The Truth About Participating Whole Life

Was Joe's decision to purchase a whole life policy over 46 years ago a good decision? Some consumers believe whole life is an obsolete product that pays poor return.

Why then do many critics of whole life support the buy term and invest the difference theory? My thought is that the common belief that a good stock or mutual fund should outperform a whole life policy, has run its course. This is what everyone was saying and now those who had their money in the market have watched there life savings dwindle and no one knows where the bottom is now.

This is an idea that many rich have used for over 200 years. Whole life has literally been around since our country's inception. Now that the market has proven its unreliability, whole life is returning as more than a safe investment, but rather a high returning investment.

Now I cannot guarantee your policy's performance, but I can show you how these policies are able to perform so well when compared to other strategies like:

- Whole Life vs. bank CDs

- Whole Life vs. savings bonds

- Whole Life vs. Term Insurance + Invest

- Whole Life vs. Guaranteed UL

- Whole Life vs. UL + Invest

- Whole Life vs. Variable

Saturday, August 14, 2010

To Tax or Not to Tax, that is the... JK it's Tax

Here is a link to the bait and switch tactic used to fool supporters of the Health Reform bill. It seems that the penalty for not owning health insurance is not considered a tax until... the judge asks.

Read the full story here.

Wednesday, August 11, 2010

Man Sues Over Health Insurance Fine

Monday, August 9, 2010

Obamacare Chart

I came across this chart and literally laughed out loud. Am I the only one who feels overwhelmed about health care? Well if it makes you feel any better I am focusing more on life insurance now.

—

Alpine Agency

T: +843.532.8367

F: +843.971.1813

http://b-nice-intime.blogspot.com

Find me here too:

Thursday, August 5, 2010

Are They Getting the Point?

—

Alpine Agency

T: +843.532.8367

F: +843.971.1813

http://b-nice-intime.blogspot.com

Find me here too:

Saturday, July 17, 2010

Identity Theft Statistics

|

| Identity Theft Statistics |

Friday, July 16, 2010

Health Insurance Blog

I hear crazy stuff from people every week about what good a health insurance blog will do. Well the biggest reason I promote my own health insurance blog is that it gets results. I first started blogging about 2 years ago and when I did it was because I read a get rich quick article and started a blog.

I made one post and then stopped for a long time. It wasn't until February of this year that I picked up the health insurance blog again, and even then I wasn't sure what to write about. I was posting on every thing under the sun, like real estate, funny videos and articles, and even politics. Lately I've been seeing the benefit in specializing in a niche on my blog. Hence the recent change in this website.

|

| Health Insurance Blog |

All I'm saying is that this health insurance blog has been getting moderately good results. I have had several folks email and call about what kind of insurance would work for them. We chat about their situation and discuss a method or plan out which type to purchase. It's all very simple and when we've finished I have satisfied customer and it's all because they read a very simply put health insurance blog.

On top of all that the website itself is making money. There are a couple of well designed and modified advertisements all over this page that when clicked generate income. I have paid nothing for this site except for time and effort and energy, I'm getting paid and I'm producing prospects that turn into clients. Not bad for free, huh.

My health insurance blog (and I do emphasize my) is a self sustained lead generating site that is all my own. I do not think that there is an

Monday, July 12, 2010

Types of Life Insurance

The types of insurance can vary depending on what suits your lifestyle. If you are looking to protect a particular period of time or want the cheapest form of life insurance then term would probably suit you. And if you think you want reliable premiums and coverage that lasts your entire life then whole life would be your best bet.

Here are 3 types of life insurance:

|

| Term life insurance |

2. Whole life insurance- This type of life insurance guarantees a death benefit for an entire life. The premiums are set but are higher than term insurance. This type of insurance also creates a cash value that the policy holder has access to and may take out loans if he/she likes. Whole life is also known as permanent life insurance because can last for the policy holder's entire life.

3. Universal life insurance- This type of life insurance is kind of a hybrid between the two. It is a type of permanent life insurance based on a cash value. That is, the policy is established with the insurer where premium payments above the cost of insurance are credited to the cash value. Payments are not needed every month however, the cash value could run out so it should be monitored as the policy ages. There is also a variable universal life insurance which uses the stock market and can get very complicated. Please see your life insurance professional for details.

Tuesday, July 6, 2010

Small Business Tax Credit

|

| small business tax credit |

Friday, July 2, 2010

New Blog Facelift

The new site is www.brandonvincent.onlineaor.com

Thursday, July 1, 2010

Tonight I felt something different

I hardly ever came back. I was usually too busy, or so I told myself. God would wait patiently, knocking. But tonight I gave him my attention and the shame fell away. The sin was forgiven, I felt it... passion. It has been a re-occuring theme these past couple of days and it has been missing. I kept telling Elizabeth, something is off. I feel like something spiritual is attacking us. I prayed a running prayer, you know one of those, "God this is inconvenient for me do something" prayers. Something was definitely side tracking us.

Elizabeth told me today she wanted to go to Fuel. In my mind it sounded like we should go but immediately all of the excuses came as to why we shouldn't. I was tired, we had a busy day tomorrow, its so far out of the way. Its funny how little things become big things right before God does something big.

When we got there, I just had a good feeling, like God was going to meet us. Normally I feel like Fuel isn't for me because its designed for the teenagers. But tonight I put that behind me asked God to meet me. He did.

Fuel had just got back from Forward conference and I knew they were going to be amped up on that trip. I wanted what they had. I craved it, and could smell a sense of purpose. God was tapping and all the while I was slowly turning towards Him. Giving Him my attention now. Responding. Here I am Lord. I felt His passion, not just for myself but for all those kids in the room with me. They need Him. They want Him. And there are many out there who don't know Him. I know Him and how thankful I am that I do.

God you have given me a family that knows you and I know there are people out there who are not as fortunate. I am available if you want to use me to help them though I don't know how to help.

Tuesday, June 29, 2010

Health Insurance For Kids

|

| Health Insurance for Kids |

They even have low premiums and deductibles, prescription drug card, emergency care, annual eye exam and limited dental benefits. If you need a quote just click here and let me know. If you have children this is a great way to insure them and chances are it will be less than a family plan. Health insurance for kids doesn't have to be complicated.

Tuesday, June 22, 2010

Health Insurance Gang

|

| Mt Pleasant Health Insurance |

|

| Mt Pleasant Health Insurance |

|

| Mt Pleasant Health Insurance |

|

| Mt Pleasant Health Insurance |

|

| Mt Pleasant Health Insurance |

|

| Mt Pleasant Health Insurance |

Friday, June 18, 2010

New Alpine Agency Video

Health Insurance Companies are Reform Proof

—

Alpine Agency

T: +843.532.8367

F: +843.971.1813

http://b-nice-intime.blogspot.com

Find me here too:

Wednesday, June 16, 2010

Purchase Life Insurance

You may be able to get a 20 year term policy right now for as little as 10 dollars a month. That is pretty inexpensive so you have no reason not to Purchase Life Insurance. There is no reason not to have a policy on yourself to protect your wife, kids and other loved ones in case the worst should happen to you.

I just recently took out a policy on myself for my wife in the circumstance that something should befall myself, she will be the beneficiary of 50,000 dollars. The younger you are the cheaper insurance will be so think about it now. Call me for a quote and Go Purchase Life Insurance.

Tuesday, June 15, 2010

Temporary Health Insurance Coverage

We tried several times to get individual coverage with BlueCross and Carolina Care, but neither would accept her. So now what we are doing is temporary health insurance coverage with Assurant Health insurance. It is less expensive than an individual plan but it only lasts for 6 months. My wife likes to call it train-wreck insurance although it works just like an individual plan.

It works out great because we do plan on getting her on a group plan with her job at some point in the near future but if she were to get into an accident or something tragic were to happen, then we'd have something to rely on. I am excited to find temporary health insurance coverage option available to us. Let me know if you have a need for temporary health insurance coverage.

It works out great because we do plan on getting her on a group plan with her job at some point in the near future but if she were to get into an accident or something tragic were to happen, then we'd have something to rely on. I am excited to find temporary health insurance coverage option available to us. Let me know if you have a need for temporary health insurance coverage.